Progress in New Jersey shows how East Coast grid operators are moving forward with proactive transmission investments for new offshore wind projects.

In the next few months, the New Jersey Bureau of Public Utilities (NJBPU) will award a project to build an underground onshore transmission corridor to deliver power from offshore wind projects, following a competitive tender earlier this year.

The corridor, which is part of New Jersey’s plan to build 7.5 GW of offshore wind capacity by 2035, will connect a landing site for four offshore wind farms to a planned substation that will inject the clean power onto the backbone of regional PJM transmission network.

The PJM network was historically designed to carry power from generation facilities in Ohio, Pennsylvania and Illinois to population centers on the East Coast and new offshore wind farms will require more capacity from East to West.

The corridor should alleviate some of the onshore transmission risks for offshore wind developers and is part of a portfolio of projects set out by New Jersey under a new State Agreement Approach, opens new tab led by PJM.

Bidders in the tender include a partnership between National Grid Ventures and Con Ed Transmission and the corridor is expected to be operational by 2029.

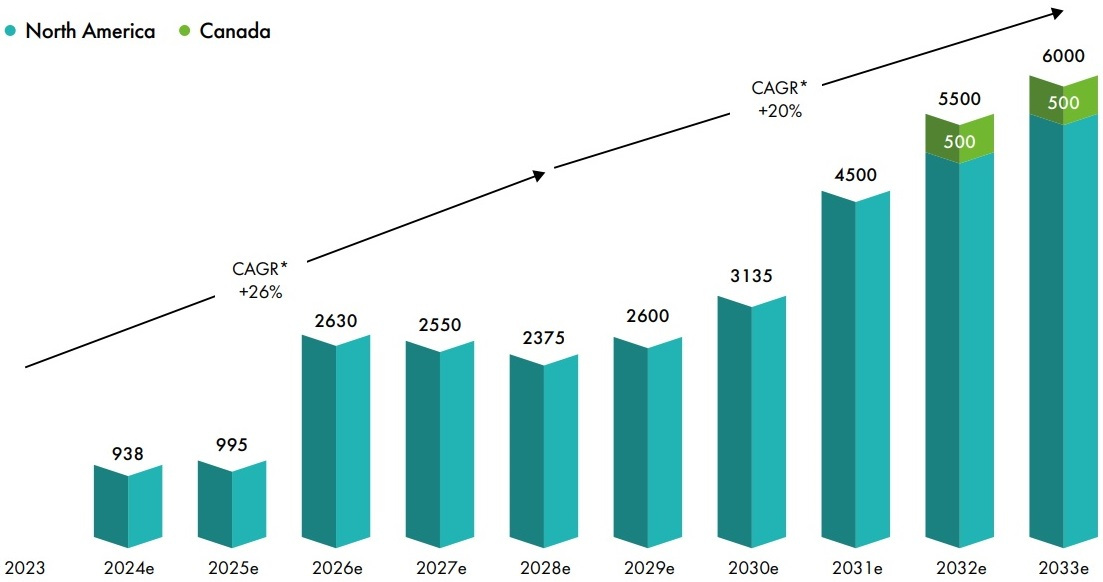

CHART: Forecast annual offshore wind installs in US, Canada

Source: Global Wind Energy Council’s (GWEC) Global Offshore Wind Report, June 2024. Purchase Licensing Rights, opens new tab

A lack of transmission capacity will become an increasing problem for offshore wind developers as the U.S. pushes towards its goal of 30 GW offshore wind capacity by 2030. Developers have already had to navigate soaring costs, supply disruptions and a lack of installation vessels, opens new tab, leading to several project cancellations.

“For offshore wind developers, connecting onshore to the grid has become a major risk factor and a major time sink. The New Jersey approach will not only lower total customer costs but also risks for offshore wind developers,” said Joe DeLosa III, a Manager at the Brattle Group, a consultancy that has advised the NJBPU on its transmission plans.

State support

Transmission projects can be derailed by local opposition and after studying several proposals, New Jersey decided a corridor that uses landing points on state-owned land was the most feasible option, using analysis conducted by Brattle.

“Selecting a specific landing point on state-controlled land streamlines permitting, enables robust advance vetting of the site, and reduces community impact,” DeLosa said.

NJBPU defined the endpoints for the corridor, leaving developers to bid their proposed route.

“By pre-building ducts to accommodate the cables for multiple wind farms, the number of individual construction efforts and associated community impacts are reduced significantly,” DeLosa noted.

For exclusive wind insights, sign up to our newsletter. , opens new tab

Planned offshore wind farms that will connect to the corridor include the 1.3 GW Attentive Energy Two (TotalEnergies and Corio Generation) and the 2.4 GW Leading Light Wind (Invenergy and energyRe) projects. Both were allocated power contracts, opens new tab by New Jersey in January and are due online after 2030. Attentive Energy supports New Jersey’s efforts to proactively plan for transmission infrastructure for the offshore wind sector, a spokesperson said. The company declined to comment on the transmission tender.

It is unclear what other projects might benefit but New Jersey in May launched its fourth offshore wind auction, opens new tab to secure between 1.2 GW and 4 GW of additional offshore wind power.

The substation connected to the corridor is being built by Mid-Atlantic Offshore Development, a 50:50 partnership between Shell and EDF Renewables. The two companies are building the 1.5 GW Atlantic Shores 1 offshore wind farm, which is scheduled to start producing power in 2027 and will use a different landing point further south.

Bidding for grids

National Grid Ventures and Con Ed Transmission presented a bid called the Garden State Energy Path, which would enable the delivery of around 6 GW of offshore wind energy over a 12-mile route.

The partners worked with offshore wind developers and sought to minimise community impacts, they said.

“We have deep relationships with offshore wind developers. We have spent a lot of time thinking how to do this from their perspective, in an efficient and efficient way,” Will Hazelip, President of National Grid Ventures, U.S. Northeast, said.

The NJBPU has not revealed how many bids were made in the tender and offshore wind developers will be keen for the transmission build to go smoothly.

The transmission builder will face a number of challenges, including complying with environmental regulations, securing rights-of-way, obtaining the necessary permits, and overcoming potential opposition from stakeholders, which could cause delays, warned Daniel Hagan, a Project Development and Finance attorney with White & Case.

For offshore wind developers, a misalignment between the completion of offshore wind farms and the new onshore transmission corridor “could create significant uncertainty,” White & Case said.

East Coast expansions

Progress is not confined to New Jersey. New York, opens new tab has also tendered for transmission that will inject a minimum of 4.8 GW of offshore wind capacity into the New York City grid.

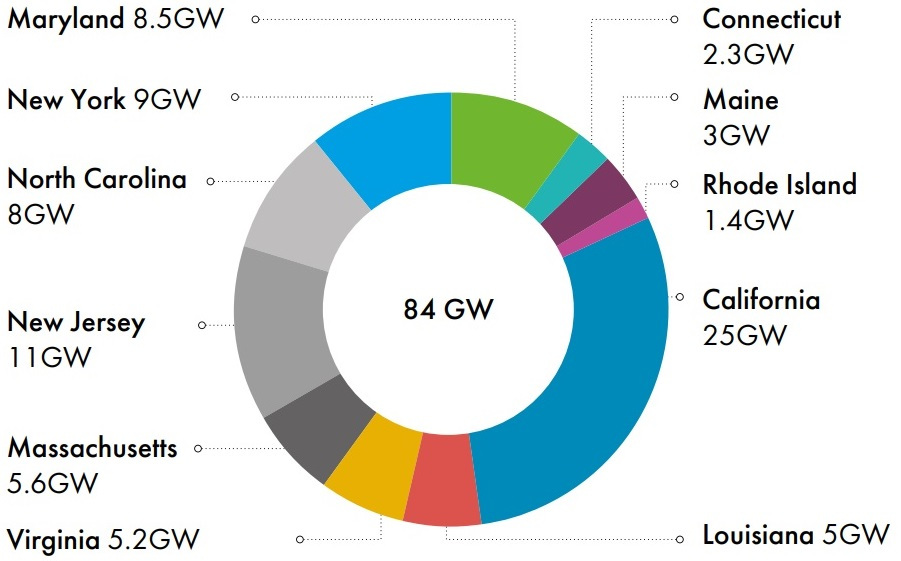

CHART: US state-level offshore wind targets

Source: Global Wind Energy Council’s (GWEC) Global Offshore Wind Report, June 2024. Purchase Licensing Rights, opens new tab

The New York solicitation, which closed on June 3, called for end-to-end proposals that include offshore interconnection points and cables, landing points, onshore transmission paths, as well as additional upgrades to existing infrastructure. The winning project would be operational by the end of 2032.

Bidders in New York include New York Transco, a transmission developer that is partly owned by Con Edison and National Grid.

Further north, the states of Massachusetts, Connecticut, Maine, New Hampshire, Rhode Island and Vermont are seeking federal funding from the U.S. Department of Energy’s Grid Innovation Program (GIP) for a portfolio of transmission projects that would unlock up to 4.8 GW of new offshore wind capacity. Their “Power Up New England” plan also calls for the installation of battery storage systems to optimize delivery.

The states have also applied for federal funding to build a 345 kV transmission line to increase transfer capacity between New England and New York by up to 1 GW.

Offshore wind developers were further boosted by new rules issued by the Federal Energy Regulatory Commission (FERC) last month that aim to accelerate interregional transmission investments.

In the first major overhaul of transmission policy in a decade, the rules require grid operators to plan large-scale transmission infrastructure projects over a 20-year timeframe to anticipate future needs. These plans will need to be updated every five years.

The rules also reduce barriers to grid investments by allowing grid operators to share the costs with the states and generators that will benefit from the new infrastructure.