Banking major Emirates NBD has launched a new initiative aimed at boosting investment in UAE equity markets by offering zero transaction fees on its digital wealth platform, ENBD X.

This move is part of the bank’s broader strategy to support the growth of domestic stocks and drive economic expansion in the UAE.

By encouraging investments in local equities, Emirates NBD aims to foster long-term growth.

The bank is also working closely with government bodies, regulators, and the private sector to strengthen the UAE’s status as a prime destination for global investors.

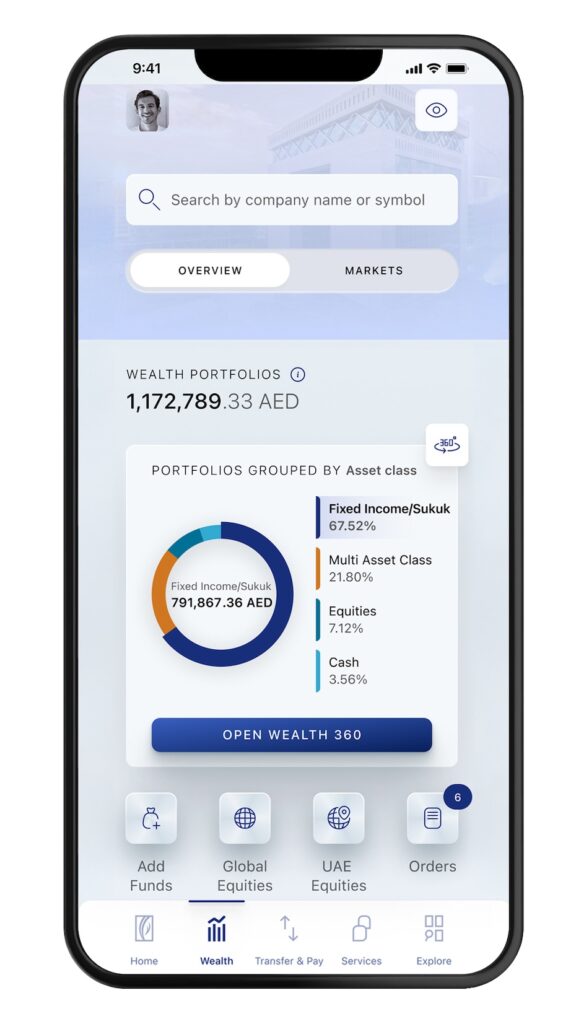

Through the ENBD X platform, customers can now invest in over 150 regional equities, with all-around access to the UAE equity markets at no cost.

It also enables investors to trade using the same app that manages their everyday banking needs, ensuring ease of access and transparency.

Emirates NBD zero-fee equity trading initiative to enable access to local markets

“Emirates NBD remains committed to financing the real economy and supporting the UAE’s long-term development,” said Marwan Hadi, group head of Retail Banking and Wealth Management at Emirates NBD.

“Emirates NBD remains committed to financing the real economy and supporting the UAE’s long-term development,” said Marwan Hadi, group head of Retail Banking and Wealth Management at Emirates NBD.

“This initiative not only gives investors fee-free access to local equity markets but also provides an opportunity to directly contribute to the success of domestic companies, further bolstering our national economy,” he said.

Hadi emphasised the role of domestic investment in strengthening local businesses, underscoring how the initiative aligns with the bank’s goal to enhance financial prosperity for its customers.

Emirates NBD’s digital wealth platform offers access to both global and regional equities, with more than 11,000 global securities available alongside 150 regional equities.

Earlier this year, the bank expanded its offerings on ENBD X, introducing fractional bonds and a ‘Secure Sign’ feature for high-volume traders, ensuring comprehensive access to financial markets through one platform.